From the late nineties to just around 2006, there was an almost decade long celebration of Western democracy, wealth and economic dominance. Japan, who was supposed to have had a seat at these celebrations declared themselves absent, as they fought to climb out of an abyss of misfortune that not even 0% interest rates could have helped. Somewhere along the way, the Japanese consumerism centred experiment cracked.

Over in the West, September 11, 2011, served up a brief bump but the existing strength of the Wests' collective economies saw off that threat. Corporate earnings soared, equity and commodity markets sizzled and our consumer centred experiment was moving along full throttle. So much so, that banks got drunk and offered 100% - 125% mortgages to even suspect clients. The grab more mentality seemed to not know how to pull back and there appeared to be no ceiling on an ever-increasing housing market. All was well with the world or so it seemed - and Western governments, as well as their corporate elite, ate happily from this table of overabundance with little thought that at some point this celebration must come to an end.

There were warnings of a correction to come but who listened and who cared anyway. Life was good on this side. I think even my grandmother could have given some advice that the good times must one day roll back. No? I listened to many analysts and economic strategists back in 2005, many of whom warned that this flight of abundance in the global economy must see measures put in place to avoid a catastrophic correction.

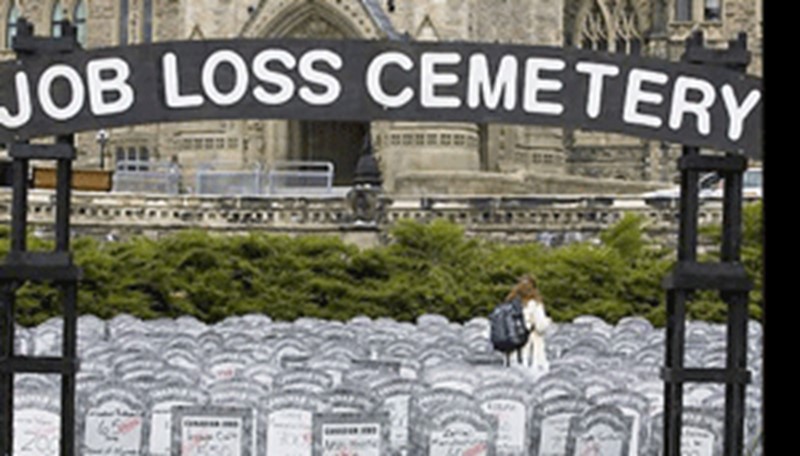

Were these warnings heeded well enough? Look around and perhaps you can give your own verdict. Many of our established democracies are struggling to ensure their populations have jobs and families have a means of securing their continued sustenance. Austerity is not just a political policy but many individuals and households are having to cut back and cut back hard. Simply put, the outlook for the global economy is not looking good.

I recall up until around 2006, global markets were doing well. Asia, America, London and even the emerging economies of Brazil, Russia, India & China (BRIC) were being touted as possible good bets. Mergers & Acquisitions activity propelled the markets forward and depending on what side of the pond you lived, protectionism was considered either a good or a bad thing. So good were things that a team of Journalists at CNBC Europe coined the phrase M&A Mondays' as part of our daily planning meetings with our colleagues in the New York & Singapore offices.

The global financial markets may have been at their most robust then but the financial markets' performance does not always reflect what is happening in the real economy. And in the real economy jobs were slowing and families were beginning to feel the signs of a squeeze.

Stocks began to fall and gradually one time safe bets did not look so attractive to investors anymore. Investor confidence went from an acute high to a severe low and it simply began to tank. Lehman Brothers failed and we know the story from there on in.

Today, the global economy is in a right rotten mess. I had hope that a recovery would have been more forthcoming after the injection of stimulus packages by both European and American governments but this recession, it seems, is a stubborn beast. It refuses to budge.

The charade we all had to endure recently; the self-inflicted crisis by the United States Congress, did nothing at all to help the global recovery or inspire investor and consumer confidence. Confidence is probably the lowest it has been for some time and for a viable and sustained economic recovery, then confidence across the board must be at respectable levels.

Blame those politicians in the United States for thinking about anyone else but themselves. I found it intriguing yet dismal watching the spectacle surrounding the debt ceiling unfold. The obvious political manoeuvring was sickening and it zapped the energy out of an already faltering economic recovery.

Blame Obama? Blame the Republicans? Blame America? Blame the Euro Zone economies? In fact, whom should we blame? Frankly, they all are culpable. The entire lot. On the American side, I support and admire the President of the United States, as he is a man in my view, who commands respect and inspires confidence. But last week, watching the debt ceiling crisis unfold, my belief in the process of politics to bring about change for the better was halfway eroded.

So what now for the global economy? Markets across the world have been tumbling for the better part of the week. Job creation seems to be a curse word these days and even some individuals with permanent jobs are not assured of their long-term future. I am interested to know what type of global economy will emerge when this recession is over. We pushed the agenda of a global village and an interconnected economy, now the blocks are falling and the effects are spiralling.

Will the US dollar still hold sway as the global trading currency if the American economy dips further? Nowadays, we can't even look to the Euro as Greek's debt issues are putting serious pressure on that currency. Some of Europe's main economies like Portugal, Ireland, Spain and to an extent Italy are very suspect. Germany, France and the UK have been sharing the load for a long time now and are showing signs of wilting under the strain if productivity does not improve in those countries.

Emerging economies may be the way to go perhaps. Many are not yet corrupted with the questionable politics and policies that have befallen the established economies of the West. They may yet be some degree of stability to be found.

One thing is certain, there is a shift happening in the global economic dynamic and it is not looking healthy for the West. All eyes are on our political and economic strategists to figure a way out of the mess we are currently in.

Photo Credit to Mario Singh

Jeevan Robinson is Editor-in-Chief of MNI Alive. He can be reached at jeevan@mnialive.com